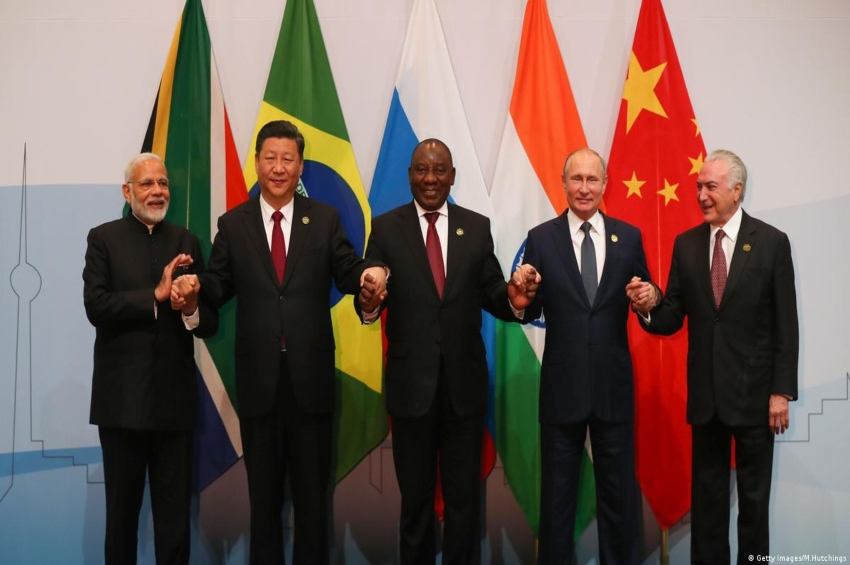

The BRICS countries – a combination of Brazil, Russia, India, China and South Africa – have recently been discussing a plan to abandon the U.S. dollar as the preferred currency for international trade and replace it with their own currencies. This plan, which would have a massive impact on the global financial system, has generated a lot of interest and discussion.

The idea of a switch to BRICS-based currencies is not a new one, but what is driving the debate now is the increased importance of the BRICS as an economic group and their increasing willingness to challenge the traditional dominance of the dollar in international trade. The dollar, for a number of reasons, has been the dominant currency of international trade and investment for decades.

The rise of the BRICS as commercial players on the world stage is certainly one important factor in the equation for a move away from the dollar, and the group has already made moves to increase collaboration between its members in order to further develop their economic ties.

A great deal of discussion has been devoted to the economic advantages that could arise from a switch to using BRICS currencies for trading purposes. The use of different currencies in international trade can help to distribute the risk of currency fluctuations, and can also reduce trading costs by using lower-cost foreign exchange services. Furthermore, free movement of currencies can create a more fluid global financial system, which can lead to increased liquidity and fairer pricing of transactions.

However, the switch to using BRICS currencies for international trade also comes with certain risks and is not without its critics. Some economists have argued that the move could potentially destabilize the global financial system, as BRICS currencies do not have the same credibility or liquidity as the dollar. Additionally, the politics behind BRICS countries have been scrutinized, particularly with regards to Russia, and it is not yet clear what impact the switch to using BRICS currencies would have on the political balance of the global economy.

The decision to move away from the dollar and towards BRICS currencies is undeniably a significant one, and it is likely that the move will not be made without careful consideration and analysis of its potential risks and rewards. While the economic benefits of such a move are certainly appealing, it is important to keep in mind the broader implications it may have on the global financial system. Only time will tell what the BRICS countries decide to do, but for now, the debate is certainly heating up.

Leave a comment